an accountmanager adds value.

Payrolling means that you as an employer are in charge of selecting your own personnel, recruit and guide them, but the risks and legal obligations that come with it are outsourced. In other words, your employees are under contract with a payrolling company and this party arranges all administrative, financial and legal matters regarding your personnel.

Together with Randstad, it is easy to set up a payroll structure. Meaning we make sure everything is taken care of for you and your employees! We will take over the legal employership. This will prevent risks and worries about:

So, you no longer have to worry about the employment contract, the payroll administration, or guidance in case of absenteeism due to illness. You can fully focus on your own work. Thats what we call being smart while hiring employees!

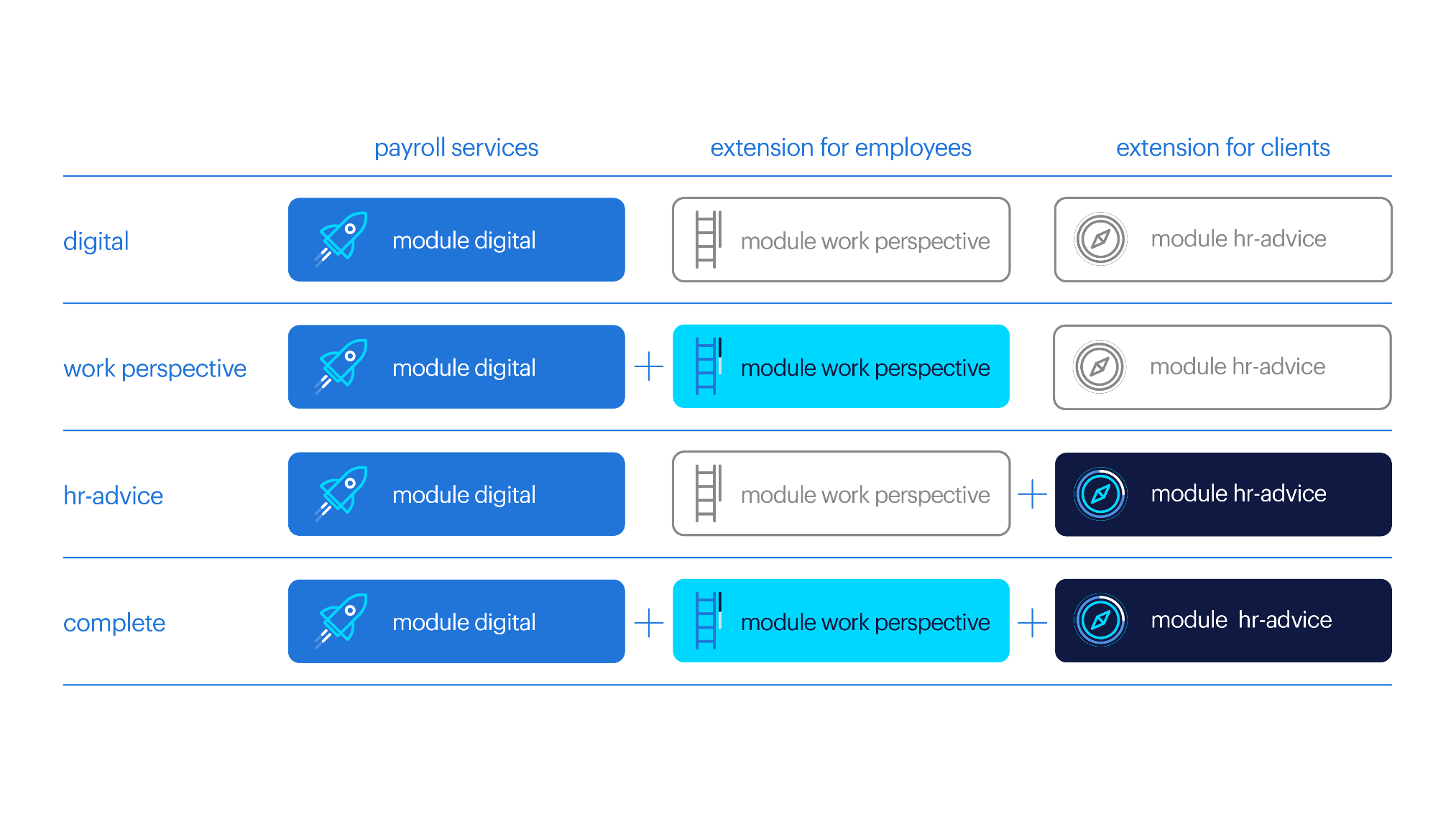

Want to know more about how payroll works at Randstad? Our payroll structures are very simple. We have three different service options that can be tailored to your organization. We call this modular pluses. The best of all services customized for you.

Whether you're looking for efficiency, convenience, or a combination of both, our system provides everything you need. Discover the benefits for yourself and experience how easy it can be to have everything in one clear platform.

In a constantly changing work environment, a good work perspective is essential. That’s why we have developed a system that is fully employee-centered.

With our advice, you not only get practical tools and insights to improve personnel policy but also tailored solutions that increase employee engagement and satisfaction.

Our complete payroll service offers everything you need for efficient personnel management. Combine digital payroll, work perspective, and HR advice and experience all the benefits for your company.

Are you curious about what else we can do for you? Contact us by asking us your question on Whatsapp! Prefer to call? We are available on weekdays from 08:30 - 17:00 at 020 398 90 30. We would be happy to explain everything to you personally.

There are several reasons why companies choose a payroll structure with Randstad:

Below you can see what such a partnership with a payroll company looks like in practice and how it helps your organization move forward:

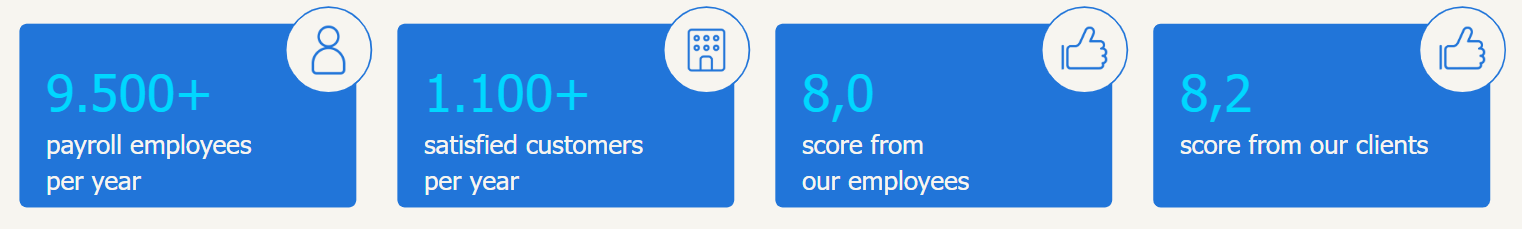

Our goal: to give everyone an 8+ for the payroll structure. We ensure the same employment conditions as permanent employees and provide advice or other workers after the payroll contract ends. Payroll employees have free access to Randstad online courses and training for personal development.

We combine our knowledge with market data and share this through newsletters, white papers, and personal advice for your personnel policy. This way, we are always prepared for market demands and personnel challenges.

We work together to find the best solution for your personnel issues. Customization, of course. Think of in-house, pool management, recruitment and selection, or a combination. This ensures that we always have the right people in the right places.

We believe in sustainable collaborations and pair you with a dedicated contact person, an account advisor who specializes in your field. This way, you always have a trusted face to rely on who knows your business well.

We hear you thinking: it’s great that you can relieve us, but what does it cost? With the form below, you can request the rate directly and without obligation.

Would you like to get to know us first or do you have other questions? Send us your question on Whatsapp or call 020 398 90 30. We would be happy to explain everything to you personally. You can also always read this blog, where we give you 8 tips to make your choice between payroll companies a bit easier!

Starting January 1, 2025, the Dutch Tax Authorities will tighten their checks on freelancers and their clients. The Healthcare, Childcare, and Construction sectors will be the first to undergo stricter scrutiny. These checks will focus on whether freelancers are performing so-called "structural tasks"—work that is also done by regular employees, such as bedside patient care.

If this is the case, the freelancer is considered to be working "under authority" and therefore does not qualify as a freelancer under the DBA law. Legally, this constitutes an employment relationship, which has tax and labor law implications. Initially, the audits and back tax assessments will target employers, but freelancers may also face correction obligations and lose certain tax benefits, such as the self-employment deduction.

Randstad has the solution to help you stay compliant with new laws and regulations while maintaining the current working arrangement: Payroll! Contact us for a consultation—we’d be happy to assist!

> or read more about this law and working with freelancers here

As a company, you are nothing without your customers, and we have the privilege of collaborating with wonderful organizations. We also do this for Payroll with GGD Groningen and Zuyd Hogeschool! Read more here about how they experience this collaboration.

> the meaning of payrolling for GGD Groningen

> the meaning of payrolling for Zuyd Hogeschool

More than 1000+ clients and customers rate our services with an 8+. Want to know more about how we achieved this success? Send us your question on Whatsapp or call 020 398 90 30. We would love to personally explain what payroll is and how we can help your business.

Over the past 60 years, we have been the worldwide hr-expert specialised in different fields of work. That is why you can trust us with your eyes closed on our knowledge and experience. We are always eager to know how the market is or will be moving, and we have up-to-date knowledge about collective agreements within those different fields. We offer security with an extended network of legal specialists, to make sure contracts will always follow the latest laws and regulations. Therefore your organisation will be ready to face today and tomorrow.

Randstad is the hr-specialist within these fields:

A payroll agreement is a 'contract' between two companies in which agreements are set about the legal employment status of employees. This concerns employees who have been selected by the client, but are Randstad's responsibility for legal employment status and associated risks. The agreement also discusses which selected product forms are best suited for your company and which arrangements are involved.

Want to know more? Get in touch with our advisors!

Payrolling means recruiting your own employees without taking care of contracts, administration and other employer obligations. It actually brings numerous advantages for employers. Recruit, select, and guide your own employees, we take care of the rest.

Want to know more? Get in touch with our advisors!

When working with a payroll construction, you outsource the legal responsibility you have as an employer. This means you are in charge of recruiting, selecting and guiding the new employees, but you don't carry these risks. You also don't have to do the payroll administration, we take over those tasks for you.

The portal process is as follows:

This way we take care of everything for you!

Want to know more? Get in touch with our advisors!

We offer numerous advantages for you and your company through payrolling:

Want to know more? Get in touch with our advisors!

Since the 'balanced labor market act' was introduced in 2020, payroll companies are obligated to follow the client's collective labor agreement. This gives payroll employees the same rights and rewards as permanent employees. In addition, this means the costs of payrolling are dependent on the employment conditions. When working with Randstad for payrolling, depending on the selected product, the conversion factor can start at 1.77. We are happy to get in touch with you to give more information on the costs for your specific situation.

Example calculation 'regular payroll employees':

Example calculation 'AOW workers':

> get a price quote from our team

> get in touch with our advisors and ask all your questions

No! If you, as an employer, have recruited employees who you want to deploy from The Netherlands, we can help you! Randstad takes over the legal employership of these employees. That's why it's not necessary to have an entity in The Netherlands.

Since Randstad Payroll Solutions has also been a recognized reference at the IND* for years, we are able to pay residents of the European Union and abroad. Invoicing abroad is also no problem, as long as we have approval from your legal and risk department.

*IND = Immigration and Naturalization Service

Want to know more? Get in touch with our advisors!

When working with candidates on assignment, you work with temporary employees and we recruit those employees for you. When working with payrolling, you are in charge of your employees, but we take care of the administrative tasks and payroll administration for you.

Want to know more about the difference? Get in touch with our advisors!

The difference between secondment and payrolling is in the agreement. In both cases, there is a legal employer, Randstad, and a client. When you work with secondment, a client calls on Randstad to find suitable employees for an assignment with a fixed term. When this assignment has been completed, the employee will return to Randstad.

With payrolling, exclusivity applies to the client that recruited the employee. Randstad follows the term as discussed by the client and employee and when this contract expires, the employee's contract with Randstad will expire as well.

Want to know more? Get in touch with our advisors!

Yes. You can payroll your AOW workers*, highly skilled migrants and interns. We charge lower rates for these employees. Want to know more? Fill in this contact form, or call us on 020 398 90 30. Read more about payrolling highly skilled migrants here!

*AOW pension = a basic state pension provided by the Dutch government to people who have reached the pension age

*AOW workers = the people receiving this pension

Yes, Randstad has been a recognized reference at IND* for years. Your highly skilled migrants can be payrolled with Randstad. In addition, we can facilitate special conditions such as the 30% percent ruling and even take over the complete application.

*IND = Immigration and Naturalization Service

Want to know more? Get in touch with our advisors!

Your employees are in good hands! We always pay all employees on time and in accordance with your collective labor agreement. In addition, we also offer numerous extras. When working with us, employees have access to our online My Randstad portal. Here they can find their pay slips and declarations. All employees can also follow free additional courses and trainings.

Want to know more? Get in touch with our advisors!

When an employee of Randstad Payroll Solutions becomes ill, we (Randstad) are always responsible for the 'Gatekeeper Improvement Act'. We are the employer on paper and support and guide the employee during this illness. We are also responsible for a succesful reintegration. Of course, all of this happens in contact and consultation with you as our client. As a client, you can choose whether you want to insure your healthcare costs through Randstad or whether you want to bear this risk yourself.

Want to know more? Get in touch with our advisors!

Yes, as a payroll employee you are employed by the payroll organisation. When working with us, Randstad Payroll Solutions will be that organisation. The payroll organisation has made agreements with your employer regarding the hirer obligation, takeover of employees and the term of the contracts.

For payroll employees, the fixed-term employment contracts, as mentioned in the collective labor agreement of the client, are applied. The client and the employee make binding agreements about the duration of the assignment. Randstad follows the agreements made and will facilitate this.

Want to know more? Get in touch with our advisors!

► contact us by calling: 020 398 90 30 (we are available on weekdays from 08:30h - 17:00h)

► you can also ask your question by sending it to us through Whatsapp

We would love to assist you in finding a solution fitted to your company!